Editable Irs Form 433-A 2022-2025

Show details

Hide details

Rm 433-B. Taxpayer s Signature Spouse s signature Date After we review the completed Form 433-A you may be asked to provide verification for the assets encumbrances income and expenses reported. Documentation may include previously filed income tax returns pay statements self-employment records bank and investment statements loan statements bills or statements for recurring expenses etc. IRS USE ONLY Notes Sections 6 and 7 must be completed only if you are SELF-EMPLOYED. S for 6 months or ...

4.5 satisfied · 46 votes

form-433-a.com is not affiliated with IRS

Filling out Form 433-A online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A full guideline on how to Form 433-A

Every person must declare their finances on time during tax season, providing information the Internal Revenue Service requires as precisely as possible. If you need to Form 433-A, our trustworthy and straightforward service is here at your disposal.

Make the following steps to Form 433-A quickly and precisely:

- 01Import our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Go through the IRSs official guidelines (if available) for your form fill-out and attentively provide all information requested in their appropriate fields.

- 03Fill out your document using the Text option and our editors navigation to be certain youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the toolbar above.

- 05Make use of the Highlight option to stress particular details and Erase if something is not relevant any longer.

- 06Click the page arrangements button on the left to rotate or remove unnecessary document sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to make sure youve provided all information correctly.

- 08Click on the Sign tool and generate your legally-binding electronic signature by uploading its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to e-file your tax statement from our editor or choose Mail by USPS to request postal report delivery.

Select the best way to Form 433-A and declare your taxes online. Give it a try now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is Form 433-A?

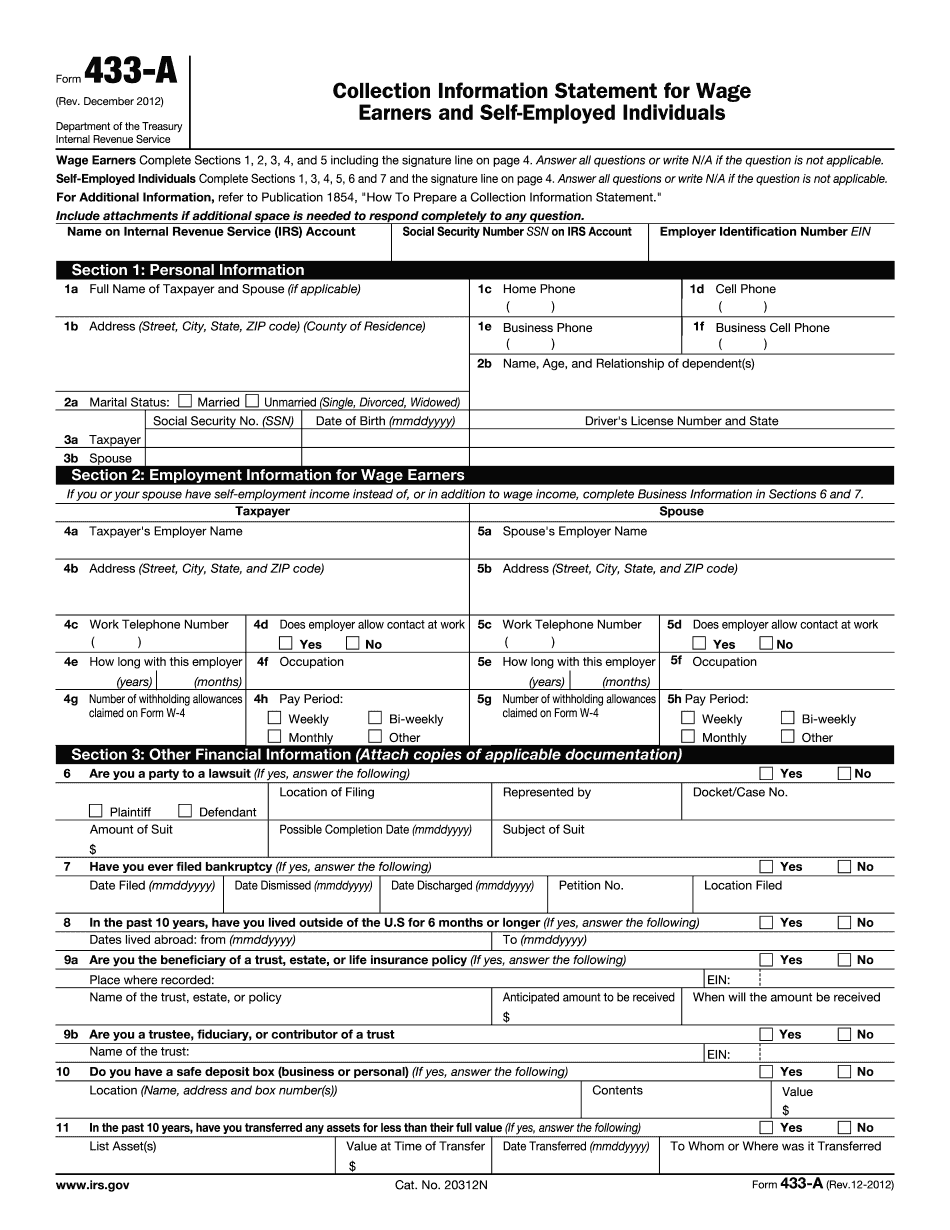

The Form 433-A is a tax document, officially named the Collection Information Statement for Wage Earners and Self-Employed Individuals. Complete and submit this form to the Internal Revenue Service in case you owe Federal income tax that you can not pay in full. Completing this sample, you prthe IRS with detailed report about your financial situation. While the 433-B is intended to collect financial details about businesses, the Form 433-A is commonly sent to the individuals who work for some companies and to self-employed individuals.

There are four sections in 433-A form that should be completed. If both of a married couple owe unpaid taxes, both spouses must complete the sample jointly. Look through the list of details to include:

- 01Personal data such as date of birth, social security number, address and drivers licence number.

- 02Employment materials about a taxpayer and their spouse: an individuals current income.

- 03Other financial information, including documentation where requested. It is necessary to determine, whether a person is part to a lawsuit or they are the beneficiary of a trust, estate or life insurance policy. IRS needs to know about any source of assets or future income with which to pay the outstanding tax debt.

- 04Any personal assets, such as real estate, vehicles, bank accounts or investments.

Attach the respective documentation and submit the final document with the IRS. Dont forget about opportunity to fill out and sign the template online. Digital forms can save you time greatly.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 433-A?

Section 1. The purpose of the application is to investigate whether anyone or more listed companies has any connection with the company or people who were accused of having an association with drug cartels and is involved in any way with activities that can cause harm.

In this section you have to fill the information according to the form. Please do this carefully. It is very important to fill all the necessary information in correctly.

Section 2: What type of information do I need to fill from the Form 433-A? You will need to fill in the details of either or both the company and the person or people accused of having an association with drug cartels. This is needed to identify the companies responsible for the information. The companies are the ones to tell you which other companies or people they had an association with, and which company to tell the prosecutors and the police. It isn't relevant to tell the authorities which companies in whose company names you have the name. Only the companies who are named in the police reports are required to give information.

Section 3: You will provide names, addresses, phone information, and other personal information about the people accused.

In the past, many of the accused gave full names and addresses, for instance, the person accused was named Juan Carlos Barajas, and the first three numbers of his phone number were: 8639371277, 8639371278 and 8639371279. These numbers are on the police reports, and will be found at the website, and also at the website of the National Prosecutor's Office. So you should provide also details of the persons you suspect had a relationship with Juan Carlos Barajas, including:

Name of person accused of having association

Address where accused lives

Home phone number

City where accused lives

City where accused was employed

Date of birth

Age

Email address

If one of the accused is the defendant, the police is required to also contact the prosecutor for a “Statement of Evidence” (La), which is a legal document used to prove the defendant is guilty. This will include all the facts of the case, if there is a prosecution, and if the defendant is not implicated: the charges, if one or more people have been investigated for being connected to drug trafficking, the information on the suspects that were investigated.

Who should complete Form 433-A?

You may complete Form 433-A only if your disability is a disabling medically determinable impairment that has had a medically determinable impact, or if your disability is a mental or cognitive impairment that is reasonably likely to produce death or major medical complications.

Why do I need to complete Form 433-A?

Form 433-A is required if you're eligible for Social Security Disability Insurance (SDI).

What if I complete Form 433-A on my own?

If you submit your Form 433-A yourself, Social Security Administration (SSA) will send you a Notice of Action (NASA), asking you to submit information regarding your disability, to include information for this Notice. Social Security Administration (SSA) will also send you a new Form 433 if your disability is no longer reasonably expected to result in death or a major medical complication.

Should I submit a new Form 433-A if my disability has been resolved or if my disability is no longer reasonably expected to result in death or a major medical complication or if the disability became reasonably expected to result in death or a major medical complication after applying for SDI?

Yes. If you're in a situation where a disability has been resolved and if your disability is no longer reasonably expected to result in death or a major medical complication or if the disability is no longer reasonably expected to result in death or a major medical complication after applying for SDI in the first place, then you don't need to submit a Form 433-A. The SSA assumes that your disability is no longer reasonably expected to result in death or a major medical complication or to result in death or a major medical complication if you receive a Notice of Action (NASA). Once you receive a Notice of Action (NASA) from the SSA, you don't need to submit a new Form 433-A by May 1 of the year following the date of service you originally served to receive benefits for a covered disability. If you received a Notice of Action after you were determined eligible for SDI benefits, or after you received the results of a medical examination, you can receive benefits for a covered disability.

How long does Form 433-A take?

An examination will take you no more than 4 hours. Generally, you may be able to complete the Form 433 on your own. If you need assistance or assistance is needed, contact the SSA call center at.

When do I need to complete Form 433-A?

This means that only the person with whom you will complete the Form 433-A provides the form.

(2) If you expect to notify the IRS of income tax and social security for a tax year in 2014, you do not need to complete Form 433-W and Schedule A (see paragraph (4)), because you can mail the information requested by the Form 433-W to the IRS not later than Jan. 31, 2014. If you expect to notify the IRS of income tax and social security in 2015, you and other members of your household must complete Form 433-A.

(3) If you expect to notify the IRS that you are withholding federal income or social security taxes for tax year 2014, you must complete Form 433-A. The IRS will provide instructions on how to complete and mail Form 433-A to the IRS.

(4) If you want to make changes to your 2014 taxes, but no tax information is expected to change for that tax year, you do not need to complete Form 433-W. For instructions on how to complete Form 433-W to change your 2014 taxes, see instructions for Form 4442, Statement of Tax Liability for 2014(or previous tax year).

(5) You do not need to complete Form 433-W and Schedule A. However, to provide IRS access to Form 433-W and Schedule A, you must be the person authorized to make those changes.

(6) To ensure that income tax returns for prior years (tax returns) are processed consistent with the taxpayer's information from any Form 433-A, you may want to add information from your previous 2014 Form 5329 (or previous tax return) to those prior tax returns to confirm all the information on the Form 433-A is correct.

(7) You must complete and send the form to any addresses on the report, with a cover sheet. If you provide information to the IRS from a different address, the IRS cannot give you a copy of the Form 433-A. For additional information on how to file Form 433-A, go to Form 433-A Instructions.

(8) You can use tax return data to establish your 2014 taxes for 2015, depending on how many of the tax returns listed in the return information list you filed in 2014.

Can I create my own Form 433-A?

Yes., however, the following regulations apply.

Who may apply for Form 433-A?

Any person.

Can I apply for Form 433-A in more than one state?

Yes., however, the following regulations apply:

The applicant must register with the Commissioner in his or her State of incorporation or place of business. The application must include the proper address in his or her State of incorporation or place of business. If the applicant's place of business does not have a telephone number, the applicant must provide his phone number. If the applicant's State of incorporation does not have a telephone number or if the place of business has not been established, the applicant must provide his or her mailing address. The applicant must then register with the Secretary of State in his or her State of incorporation or place of business.

The forms are available online at the Secretary of State's website.

The form is available by mail:

Commissioner, Kansas Department of Revenue, 200 SW 4th Street, Jefferson City, MO 65102

Who will have responsibility for providing the forms to the applicant?

The Commissioner of Revenue will provide the forms and is responsible for verifying them for accuracy prior to submission to the Department of Revenue.

Who must pay the fee to become a member?

All applicants for the registration and issuance of a new business entity must have an agent pay the registration fee to the Commissioner.

If the application is filed with a registered Agent of the applicant, he or she must file all applicable federal and Kansas state income taxes, and pay filing fees, along with the required forms, before the tax certifying agent can take over the registration.

The agent must present a complete copy of federal and Kansas state tax forms to the business name registrar after taking initial registration and paying the filing fee.

Who is responsible for the accuracy of the application and verification of the tax returns?

The business name registrar will verify the information from any federal or Kansas State tax return prior to the effective date of application. If any of the information is insufficient for that verification, the business name registrar must request a final review of that information from the Department before final approval or denial of the application.

For information regarding this responsibility, call the business name registrar directly at and ask for the Registration Services Division.

What should I do with Form 433-A when it’s complete?

The IRS does not issue a Form 433-A. You will receive a Notice of Withholding Assessment when Form 433-A is complete. Note: When Form 433-A is complete, do not prepare an amended tax return to the IRS and file it with the Notice of Withholding Assessment on Form 433-A. Instead, use the instructions on the Notice of Withholding Assessment to amend the forms and return only the original returns. The Notice of Withholding Assessment is available at the Treasury Department and the IRS websites.

How do I get my Form 433-A?

Contact us.

What documents do I need to attach to my Form 433-A?

You must submit copies of these documents with your Form 433A-1:

Certified copy of the original birth certificate of the applicant

Original certified copy of the naturalization certificate of the applicant

Certified copy of the marriage license of the applicant

Certified copy of the consent to marriage of the applicant

Original marriage certificate signed by both parties.

What are the different types of Form 433-A?

First, we have the Form 433B — a statement used to report income taxes in a specific country on a specific amount. The Form 433B is a statement for the IRS to mail after the taxes are paid, and includes information such as the actual amount of taxes withheld, when the income was earned, etc. The Form 433B can also be submitted during the period your payment is deferred, and it can be extended again upon request.

Secondly, you have Form 433U — it is a statement submitted to the IRS by an individual on behalf of a non-resident alien or a non-immigrant to advise the IRS that the individual was or became a foreign income, net investment, estate, or gift tax resident alien, and it is required to collect, report and pay taxes due. The Form 433U is a statement submitted immediately after a non-resident alien's tax return is filed, and it can be submitted even if you are not in the United States and even if the Form 433U is filed with a separate IRS Form 2350 or 2355. This Form 433U can also be used as a statement as a substitute to one of the other tax forms.

The Form 433K — a form where the foreign earned income of an individual is reported is required by section 881 and that form is part of Form 433 that also includes Form 433U.

Form 433P — Form 433P is an additional statement required for a foreign person to report his or her foreign tax liability. Form 433P is not required by section 881. Form 433P provides for the filing of an additional F-number that allows the foreign person to determine his or her tax liability as a U.S. taxpayer.

Form 433V — Form 433V does not have any information to report on this form since it is required by section 881.

Form 429 — Form 429 is also an addendum to Form 433, and it is used to report and pay for certain excise taxes and customs duties and other sales and use taxes. This form does not require any specific taxpayer information, but is intended to be used when Form 433U or Form 433B is submitted.

Form 433-A — It is also a document that is sent to the IRS upon request by an individual or a non-resident alien. The Form 433A is used to report income taxes owing on a specific amount, it includes all the information required by the Form 433B and also provides additional information for a tax preparer to work with.

How many people fill out Form 433-A each year?

In the latest available federal data, for 2014, roughly 20 million Americans filled out the form. In total, there were about 5 million reports of tax evasion by the top 1% as reported by the Internal Revenue Service in 2014.

The Tax Policy Center's analysis of the data indicates that on average taxpayers had 7,750 in uncollected tax liabilities, which is a total of about 7.

Is there a due date for Form 433-A?

In general, Form 4334 is due on or before April 15. However, Form 433-A is not due until May 1.

How is Form 4334 filed?

Form 4334 is filed by using the U.S. Mail. You must mail your Form 4334 to:

Internal Revenue Service

Social Security Administration

P.O. Box 9150

Baltimore, MD 2

What are the filing requirements of Form 4334?

Generally, to maintain the status of an individual as an employee for federal income tax purposes, the individual must file a Form 4334 with the Federal Tax Service. This form is filed by:

Your Employer

Your Company

The individual's employer

The individual's employer's representative

The individual

The individual's estate in a decedent's estate, if the individual owned certain property to be distributed when the decedent dies

Your spouse.

A person other than an individual or person that meets these conditions. Form 4334 is not necessary if the individual qualifies for the Employee's Social Security Number (SSN) exception under the Internal Revenue Code. See Form 4104, Employee's Social Security Number Under the Internal Revenue Code for more information.

Who can sign Form 4334?

A person who is authorized to act on behalf of the individual and is authorized to sign by the individual.

When are required items printed on form 4334?

Employees who work in a covered establishment, as described below, must make certain types of disclosures on the form as follows:

Employees who work in a covered establishment if, for the taxable year, they receive an average of: A reasonable sum for expenses such as food, clothing, housing and child care incurred in providing services

at least 250 in gross income

For workers who take a leave of absence if, for the entire period of leave, they do not receive an average of less than the average of the amounts of compensation received and expenses incurred by other employees: The employer must pay into the employee's Social Security account for the entire period of leave, and at least 250 for the period of absence.

For the period of leave, and at least for the period of absence. For employees that work: An hourly minimum of 27.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here