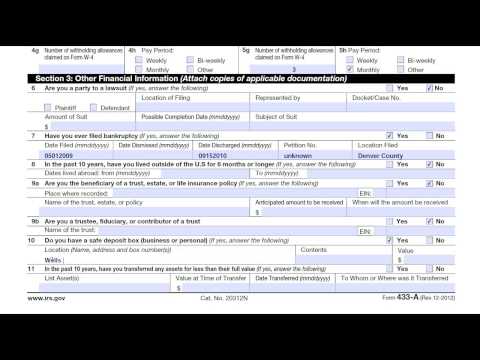

Hello, Amanda Kendall. I am here today to assist you with filling out Form 33a. This form, known as a collection information statement, is specifically designed for wage earners or self-employed individuals who need to deal with the IRS and have a revenue officer assigned to their account. In some cases, even if you don't have a revenue officer, this form may still be a better option as it includes more information compared to the alternative form, 4-3-3 F. Let's go through this form together, focusing on completing it for James and Amy Johnson. In the first section, we only need to input the primary taxpayer's name, which is James Johnson in this case. For self-employed individuals, we need to provide their social security number and, if applicable, an employer identification number. If you are self-employed and do not have an employer identification number, you can skip that section. Moving on to section one, we will enter both taxpayers' names on line one a. Next, in section one b, we will input the taxpayers' address, including the street address, city, state, zip code, and county. Additionally, please ensure that at least one phone number is provided for the taxpayers. You can input more if desired. In section 2a, you need to indicate whether the taxpayers are married or unmarried. In this case, James and Amy Johnson are married. Then, in section 2b, we will provide information about their 12-year-old son, Anthony Johnson. Section 3a is for the primary taxpayer, James. Here, you should re-enter his social security number and date of birth. Please note that dashes should not be included. If applicable, you can provide your driver's license number and state. However, for the purpose of this form, I will not be filling out that section. Finally, in section 3b, enter Amy Johnson's social...

Award-winning PDF software

433-a instructions Form: What You Should Know

How to Prepare a Payment Statement or Form 4332 — Personal Identification Number (PIN) Request Collection Information Statements (CIS) for Wage Earner & Self-Employed Individuals Preparing a CIS is an effective and quick technique to determine and collect your tax debts. CISes can also be used to assess penalties on individuals who have delinquent tax liabilities and to file a final installment agreement. Who Should Use CIS for Wage Earner & Self-Employed Individuals? • If you are not a wage earner or self-employed individual, or you are a self-employed individual who has over 5,000 in annual gross monthly income, you should prepare a CIS. Why Is a CIS Important? CISes can assist in avoiding and collecting tax debts that have not been paid or corrected because you have not filed a tax return or filed a fraudulently calculated return, and you may be required to pay interest or penalty charges. How to Prepare a CIS The Form 4332-PINS contains information about the individual who is the subject of the audit for wage or self-employment tax issues. It can also assist in determining the amount of any debt owed in connection with a tax-related dispute. The information contained on the form may be considered favorable to the individual to whom the Form 4332-PINS has been submitted, and it may assist in the determination of the amount of the tax issue. A CIS is not evidence of unpaid taxes. CIS Format for WV State Tax Department The Form 4332-PINS contains information about the individual who is the subject of the audit for wage or self-employment tax issues. It can also assist in determining the amount of any debt owed in connection with a tax-related dispute. The information contained on the form may be considered favorable to the individual to whom the Form 4332-PINS has been submitted, and it may assist in the determination of the amount of the tax issue. Who should prepare a CIS? • If you are not a wage earner or self-employed individual, or you are a self-employed individual who has over 5,000 in annual gross monthly income, a CIS is a necessary tool in the process. For individuals that do not file their personal income and income for employment taxes with the IRS, you should prepare a CIS.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 433-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 433-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 433-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 433-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 433-a instructions