Award-winning PDF software

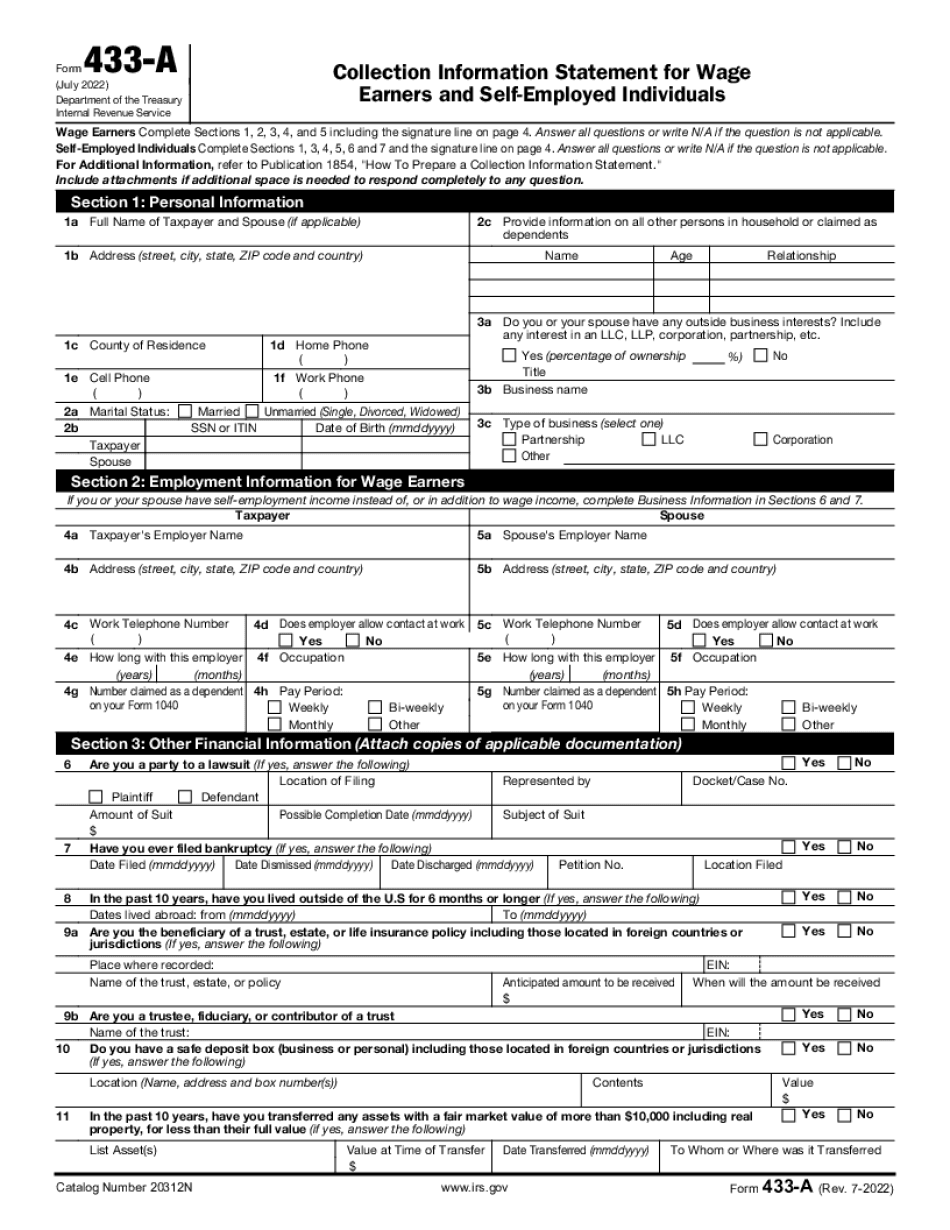

Pima Arizona Form 433-A: What You Should Know

We will make every attempt to provide information necessary to substantiate your claim of eligibility, at no charge, to the IRS. We cannot guarantee results, and your response will be handled only as accurate information. Furthermore, we will not provide a determination on eligibility, or any decision regarding, your case if payment of your tax is constrained. If we determine that you are a wage earner, your tax return will be processed as a standard individual wage/self-employment tax return. Our goal is to re-establish your qualification for credit, to assist you in establishing proper and accurate records, and to facilitate and resolve any questions and irregularities that may be related to your disability. If the information you provided is not a complete and accurate representation of your income and/or expenses, your claim for tax relief will be rejected, and your credit may be suspended or declined. IMPORTANT: If your application requires a paper form, please provide your paper form as described in the previous section. The paper form is required for the tax department to review the form and for you to sign the form. Your application will not be processed if there are no completed or signed forms. You will be asked for valid photo identification (your wage, social security, or work check). Once your application is completed, the Forms and Deadlines will be returned to you. Criminal Subpoena (N/A) You will receive an email at a later date after your application is completed. The Taxpayer's Identification Number (TIN) will be obtained from Social Security, and a TIN must be included in each tax return filed (either electronic or paper-based). The person who submits these forms is responsible for the accuracy and correctness of the forms, and must sign each form. Your TIN will be used to make sure that you are making the correct payments. To keep your TIN, you may elect to have your TIN electronically transmitted, or you may print a paper form and mail it back to the office for processing. An automated confirmation number is issued to you to provide you this service. If you do not receive your confirmation by the electronic transmission date listed on this confirmation, please check the mailbox under “How To Contact Us.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Pima Arizona Form 433-A, keep away from glitches and furnish it inside a timely method:

How to complete a Pima Arizona Form 433-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Pima Arizona Form 433-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Pima Arizona Form 433-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.