Award-winning PDF software

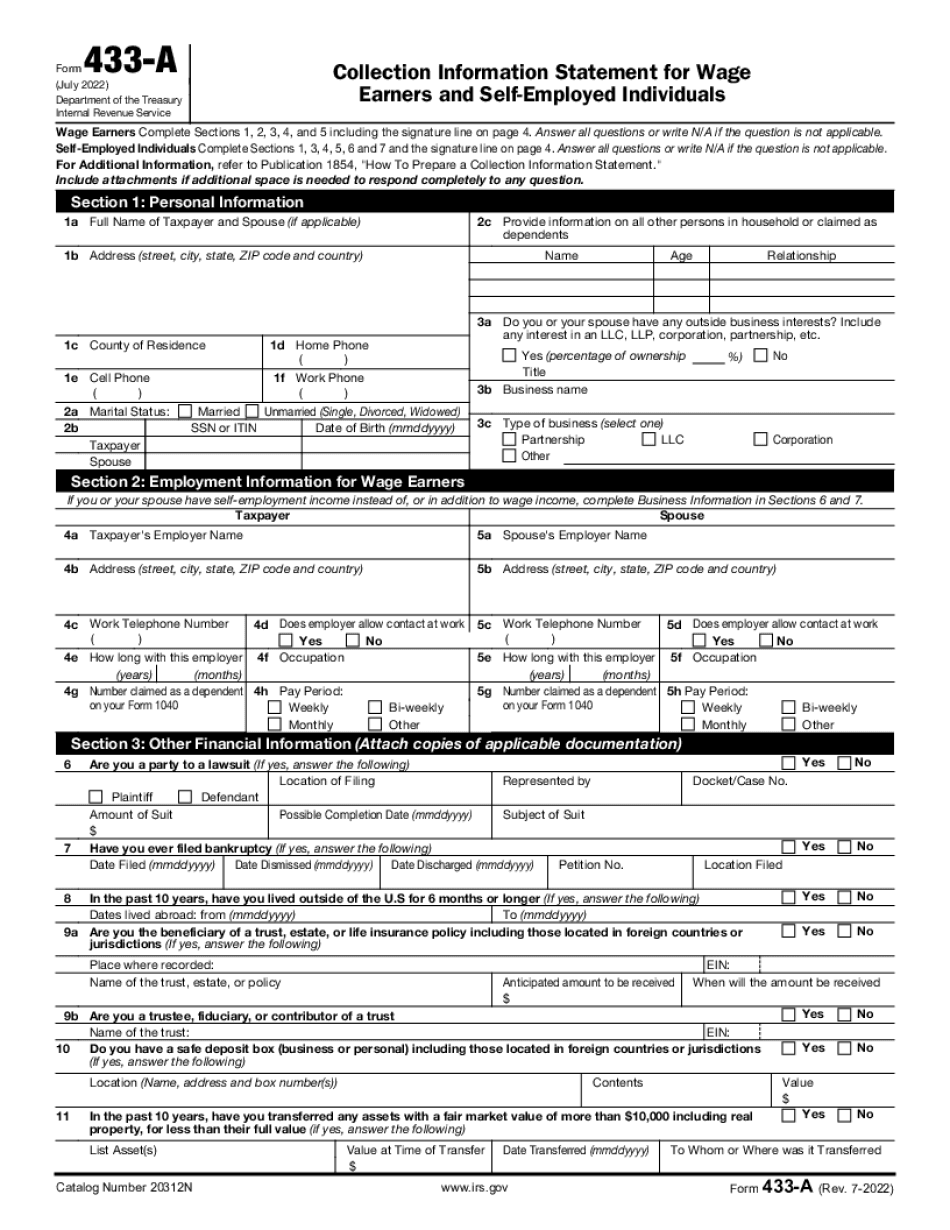

Printable Form 433-A Olathe Kansas: What You Should Know

Form, 33.1, as a proof that you actually owed tax. Tax Forms and Publications — Kathleen A Carolina CPA PC Included in the fee to complete the OIC is a completed Form 433-A, the Offer in Compromise, as well as a completed Taxpayer Identification Number (TIN) or Taxpayer Identification Number (TIN) card. The OIC should be completed in order to obtain a taxpayer code, which can be used to prove one's identity when filing an IRS audit or requesting a refund. Additionally, the OIC is a way for the IRS to verify that you are eligible to receive a refund if you have already submitted a Form 1090 and have not received a response from the IRS. A list of IRS agents and how to contact them. The list of agents is also on the website. Include: -a copy of the original Form 8284, or other tax document such as a check, a debit card or a credit card receipt to verify that the person submitting the OIC is the taxpayer -a copy of any IRS document or document on file with the IRS that relates to the tax claimed (such as a tax assessment, return or other documentation to be used in lieu of an official tax document) -a copy or transcript of the recorded telephone conversation with an IRS agent if more than one agent is used to process the request -a copy of any correspondence with the IRS if the agent is conducting a reasonable inquiry and can substantiate a tax lien -a statement that the taxpayer is a citizen of the United States or a resident of the District of Columbia or the Commonwealth of Puerto Rico if filing a complete U.S. tax return for the tax year of the OIC -an itemized list of all amounts that are due, including any interest and penalties due, with the amount due to be paid by the due date, or by the date required under section 6672(d) of the Internal Revenue Code. —proof of mailing receipt of the signed OIC if the recipient does not accept U.S. mail; all other proofs of mailing receipt must be provided to the appropriate IRS office through postal service, such as a check or electronic mail -if filing Form 1040, U.S. or Form 1040NR, Nonresident Alien Individual Elective Filing Status: -a copy of an IRS notice from the IRS to the individual (i.e.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 433-A Olathe Kansas, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 433-A Olathe Kansas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 433-A Olathe Kansas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 433-A Olathe Kansas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.