Award-winning PDF software

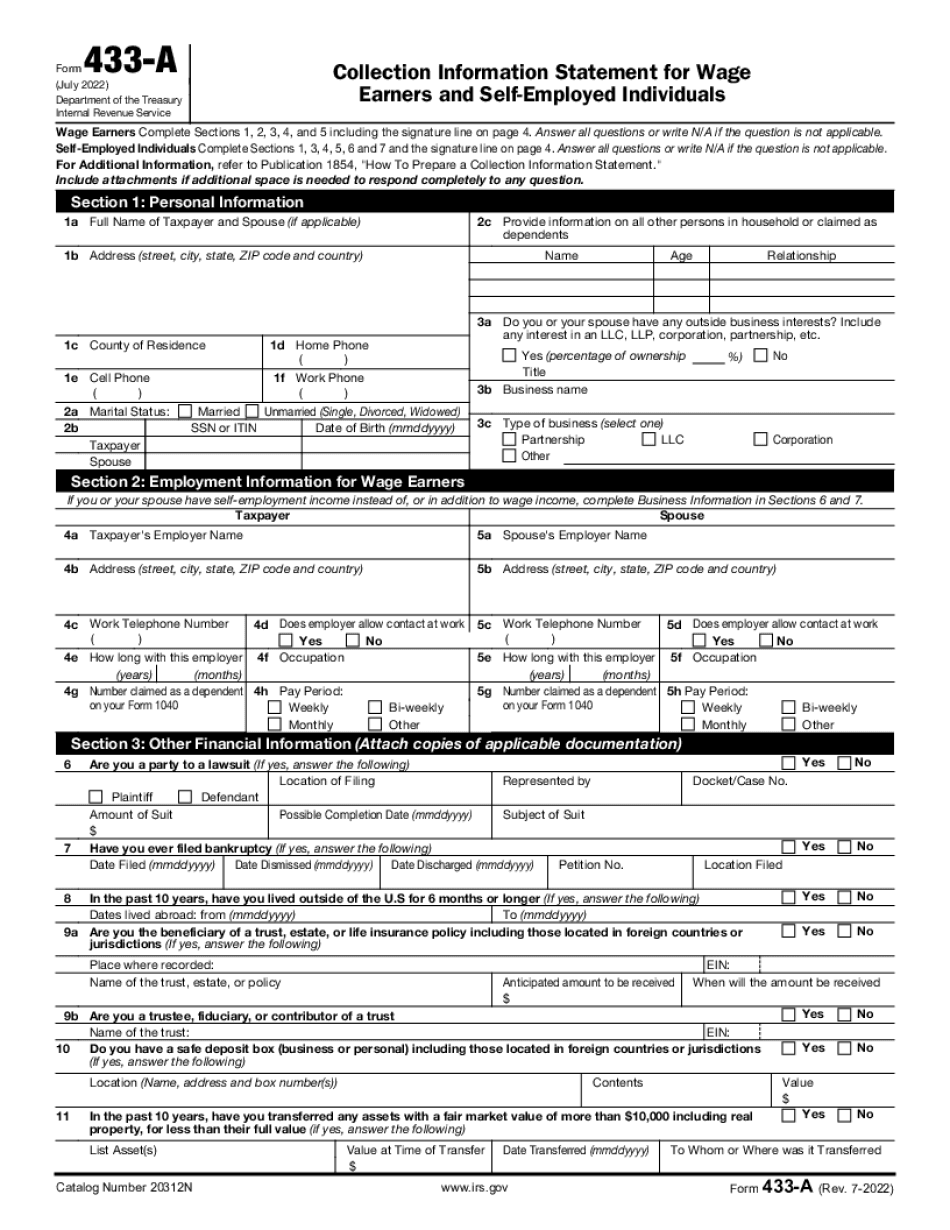

Printable Form 433-A Louisville Kentucky: What You Should Know

Fax: Fax: FEE REFUNDS AND APPEAL PROCESS We will review and grant refunds if: We will review and deny applications in the following cases: If an application does not meet the requirements, the refund process may not begin, but it will be made available to the applicant at no cost to the applicant. FEE REFUNDS Payments received if the fees were paid within the three months before the date we received the application or when the payment will be paid. Applying for a refund The refund process allows for a refund for: If your application has been accepted The fees paid before the application was accepted. Refunds may not be granted for: Refunds will be granted to the applicant who paid the fees in the three months before the date we received the application. The refund process may be used in the event the person or business is assessed another fee. If you have questions concerning the refund process please contact the following: The form you use. Payments should be made to the clerk of the Circuit Court within 24 hours from the time you apply to file a refund claim. A check or money order will not be accepted. This is a civil case that will not impact your credit score. Taxes on Sales Tax Exempt Products and Services Taxes on sales tax-exempt products and/or services for individuals If you were involved in the manufacturing, distribution, sale, use or services of an exempt item, such as a tax-exempt item listed below, in Kentucky for a taxable activity, and you do not file Forms 1040 or 1041, and the exemption amount is greater than 400 for taxable sales (1) of exempt items, or (2) total sales from qualifying sales activity for more than one taxable year, no sales tax will be charged on the sale of the exempt item. There is no payment or penalty for having an exempted item if you file Forms 1040 and Form 1041. If any proceeds from the sale of the exempt item will be applied to any other year's taxable sales, the taxes will be chargeable. If the proceeds will be applied to the taxpayer's taxable income for a period longer than one calendar year, the taxes will be chargeable for a period commencing with the taxable year in which the exempt sale occurs.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 433-A Louisville Kentucky, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 433-A Louisville Kentucky?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 433-A Louisville Kentucky aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 433-A Louisville Kentucky from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.