Award-winning PDF software

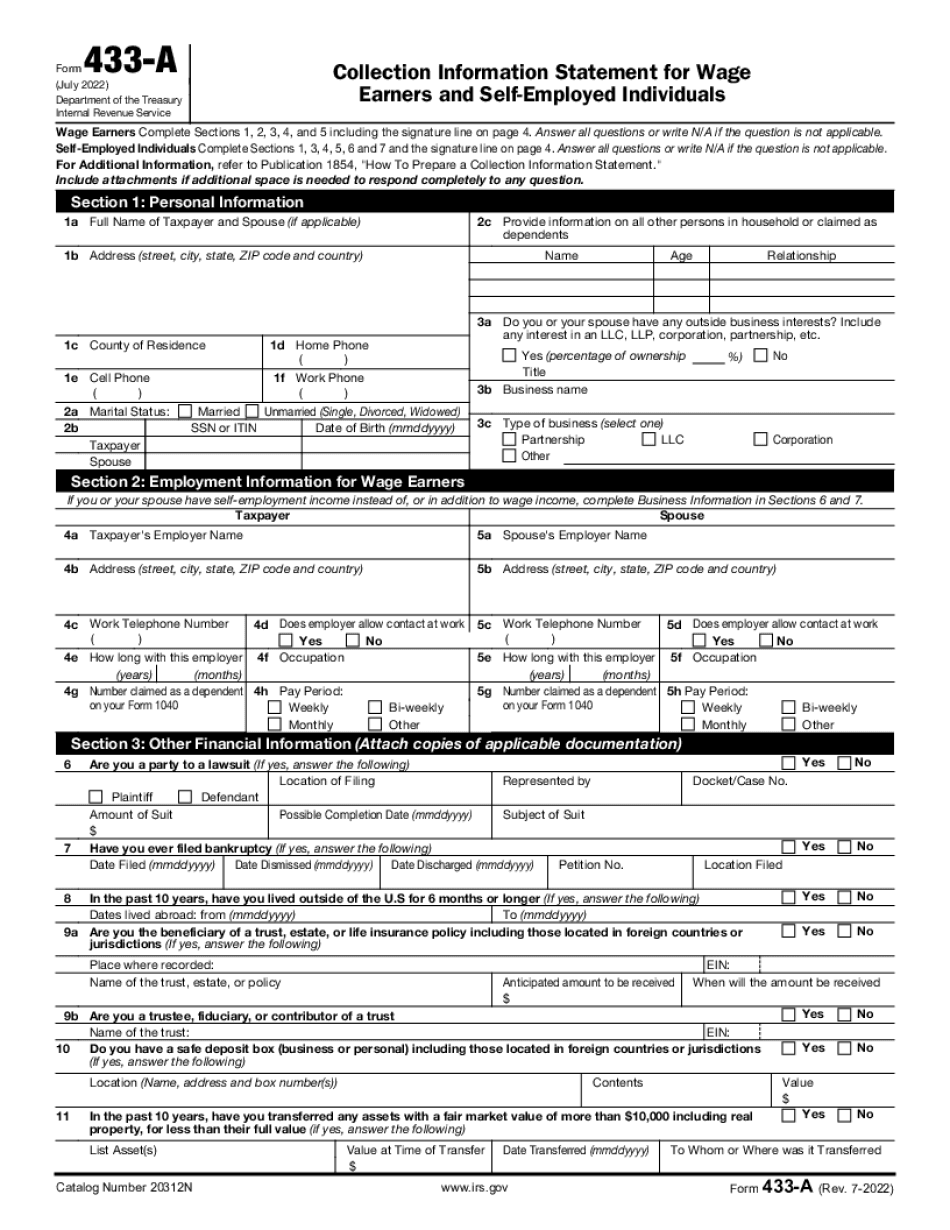

Printable Form 433-A El Monte California: What You Should Know

TTY/TDD: BOGUS CODES, INAPPROPRIATE RULES, AND CURRENT AVAILABILITY If you submit a Form 433-A or a request for a paper Form 433-A, the service center will provide you a bogus document or a current form that: (1) Is incomplete or inaccurate on the date of issue, (2) Is not valid at the time it is received, (3) Does not have all information included on the current form, (4) Contains any information incorrect on the current form, OR (5) Provides false and/or misleading information on the current form. To correct any problems with a bogus document, you will first need to contact the service center and request a new form. If you contact the service center after 6:00 a.m. PT the service center will not have the capacity to help you. They will either need an extension or may have to contact the DMV or IRS. We will send you updates and corrections to the bogus information when you contact the service center. NOTE: If you are a self-employed person or a wage earner, and you need an Individual Taxpayer Identification Number (ITIN) or Permanent Resident Alien Information (Permanent Resident Card (PRC) if you are a non-citizen), your employer is not the same. If your employer does not have an I.T. and/or P.R. code number, they do not have to submit it. If you and your employer do not have an ITIN and/or P.R. code number and your information would also be on the phony form, you will need to complete our Form 433-C: Taxpayer Identification Number Verification for Independent Contractors (Form 8863). If you have filed more than one form 433-A by telephone or e-filed, you will also need to submit a new form 433-A for your employer. The Taxpayer Identification Number for Wage Earner and Self For information about the TIN for wage earners, read the section entitled IRS Publication 549 or see our IRS Form 433-A with TIN.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 433-A El Monte California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 433-A El Monte California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 433-A El Monte California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 433-A El Monte California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.