Award-winning PDF software

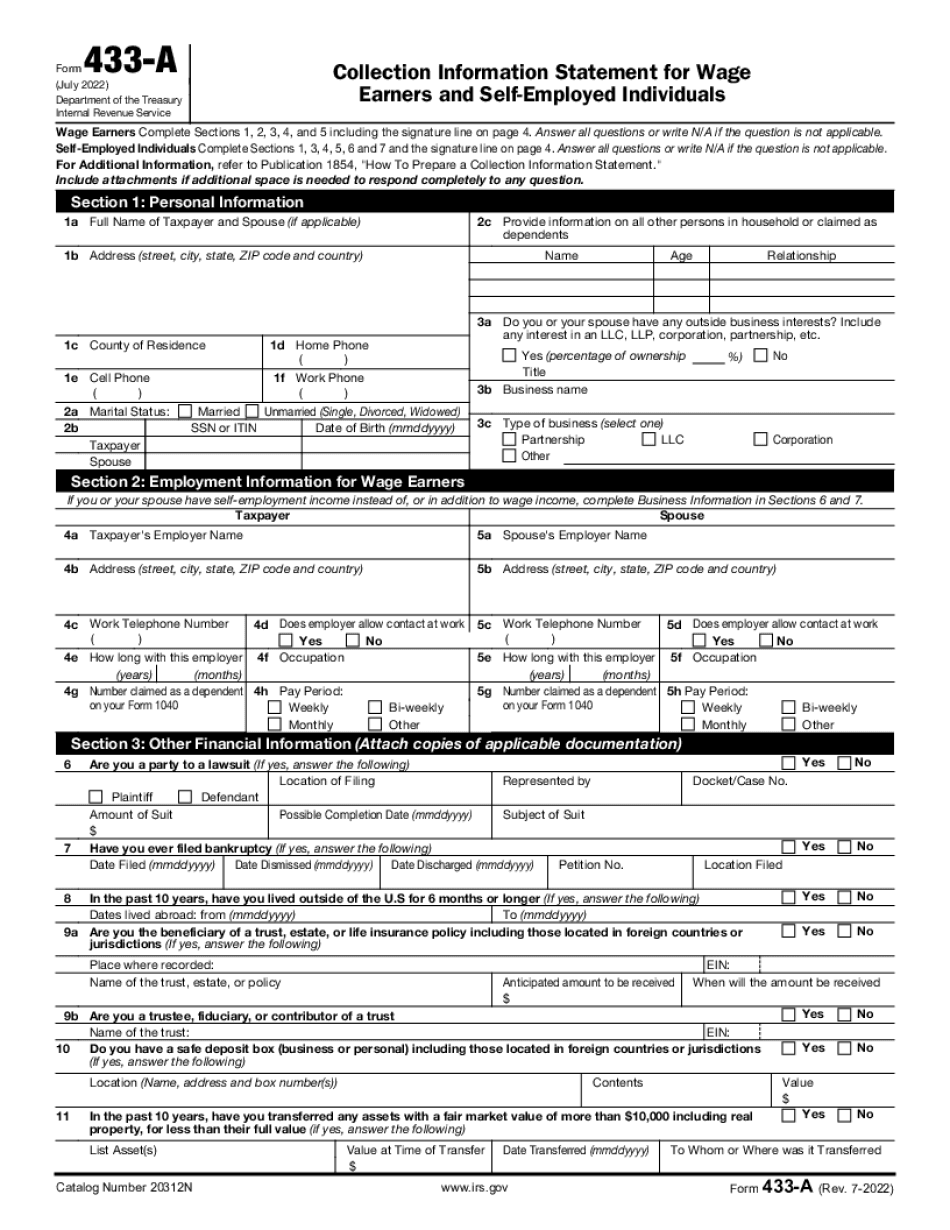

Murfreesboro Tennessee Form 433-A: What You Should Know

A Property, LLC, applicant shall be permitted to be exempt under the Tennessee Business Corporation Code, Title 5, Chapter 3, section 14 (Tobacco Products). 2. (2) Where a tobacco product is made, stored, sold or distributed by an established tobacco cooperative association, an exempt entity created under title 4, article 4, or an exempt business organization created under Title 8, chapter 12. Of the code, the tobacco product shall be identified as a tobacco product and only the name/logo, color, and type shall qualify as an exempt tobacco product. Property, LLC, applicant is a Tobacco Product Manufacturing Company. 3. (3) Except as provided in §4-15 of this ordinance and §12-18 of the charter, the business of Property, LLC, applicant is: a. Tobacco Products Manufacturing Company. b. Manufacturer of Tobacco Products. c. Business Corporation. d. Foreign Private Enterprise Corporation. e. Domestic Private Enterprise Corporation. f. Foreign Corporation. g. Domestic Corporation. 4. (4) The Property, LLC, applicant shall be permitted to establish and operate a Tobacco Products Manufacturing Company as provided in this ordinance. 5. (5) A Tobacco Products Manufacturing Company shall be granted a noncancelable tax credit of 50% of any excise and non-infrastructure tax collected on the wholesale sale of non-tobacco products, and the excess cost on sales of tobacco products. 6. (6) The Property, LLC, applicant shall be permitted to offer tobacco products to a limited number of private retail establishment and wholesale purchase by a limited number of retail establishments and by wholesale purchasers. 7. (7) The Property, LLC, applicant shall be permitted to sell tobacco products in the following quantities as specified by the Board of Health: a. A minimum of 30,000 pounds of tobacco products per year, and a maximum of 150,000 pounds of Tobacco Products per year. b. A minimum of 35,000 pounds of tobacco products per year, and a maximum of 250,000 pounds of tobacco products per year. 8. (8) In addition to tobacco products required to be sold by a tobacco products manufacturing company, the Property, LLC, applicant shall be permitted to sell a limited number of other merchandise items to a limited number of private businesses as specified by the Board of Health (including, but not limited to: e.g.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Murfreesboro Tennessee Form 433-A, keep away from glitches and furnish it inside a timely method:

How to complete a Murfreesboro Tennessee Form 433-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Murfreesboro Tennessee Form 433-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Murfreesboro Tennessee Form 433-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.