Award-winning PDF software

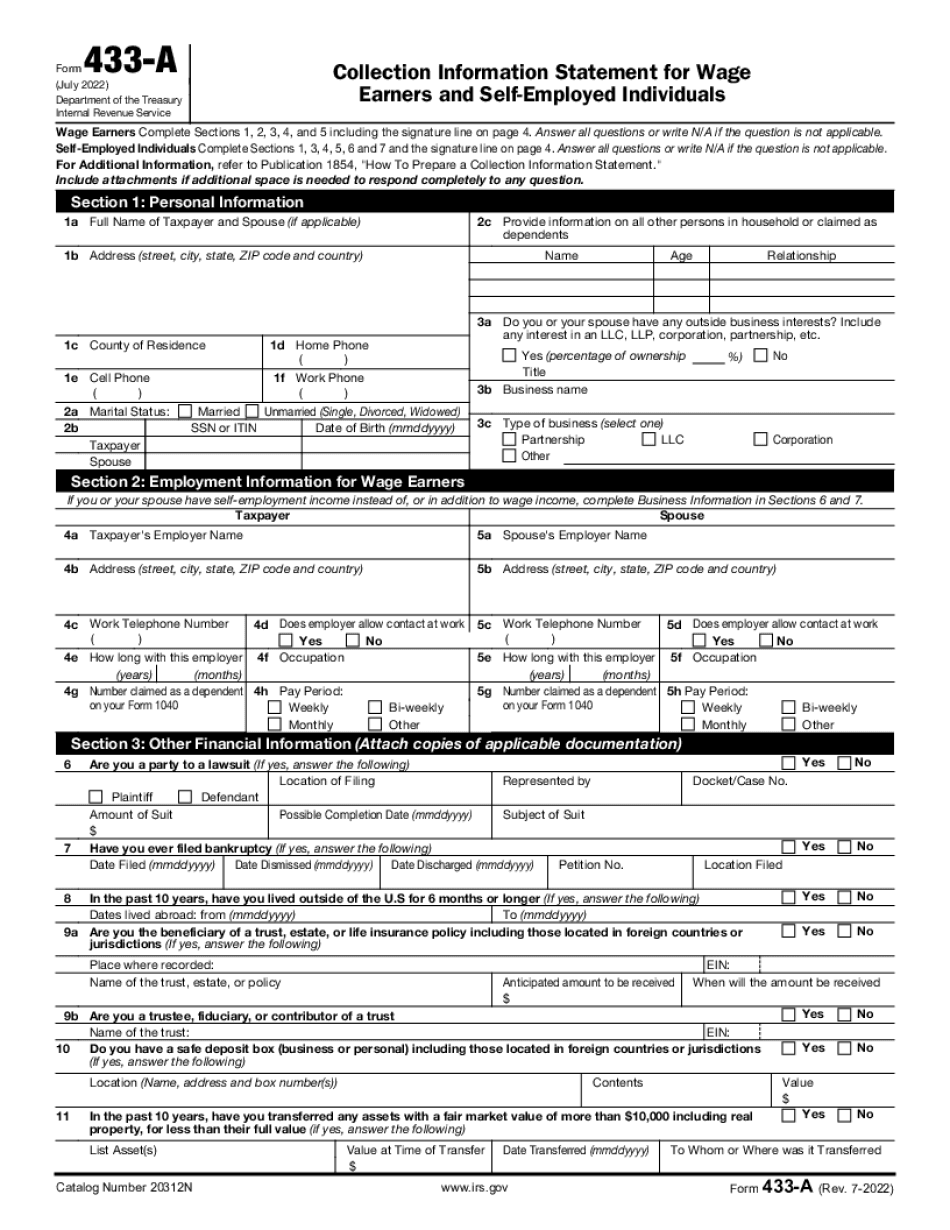

Form 433-A online Miramar Florida: What You Should Know

As attachments. Tax Rates and Credits for Wages, Allowances and Reportable Dispositions. Enter the individual's current gross wages. Your W-2 must be signed in full by you or by your employer. Enter as much information about your household as possible. You can use IRS.gov to request data from a W-2. Use the IRS' search tool to see what a W-2 report is. The following fields are required: Name of Person (usually self) Last name Place of Birth Social Insurance number If your employer withholds Social Security or Medicare taxes, enter their name and the amount deducted. You will also need to enter the employer's tax ID number. The code (tax year) assigned by the IRS is: 8 (2010 or later) Employer Name Enter the name of the employer. You don't have to provide personal information when you fill your form; however, don't omit the Social Security or Medicare number. Taxpayer Identification Number (TIN) or Other Individual Identification Number Enter the TIN or other identifying number (other than the TIN) of the individual as shown on the Form W-2. Use your TIN if the individual is an employee; otherwise, use the individual's Social security number. Amount of Wages and Allowances Enter the total of the individual's wages and allowances paid to the employer (for example, tips, deferred compensation, etc.) and any other expenses, such as employer-provided housing or travel expenses. Also use the total of the individual's reported income from any employment (including self-employment income) or self-employment (such as rental income and investment income) in determining the amount of tax payable. The amount of income is calculated from Form 1040, U.S. income tax return. Earned income and wages for 2017, as entered, will be entered in boxes 1 and 2 of the Summary Table of Earnings (W-2) reported on Form 1040, U.S. income tax return. The amount of tax on wages, allowances and reportable dispositions will not be entered in boxes 1 or 2. If the amounts required to reduce income by tax bracket are entered, the amounts for box 1 or 2 will be zero.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 433-A online Miramar Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 433-A online Miramar Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 433-A online Miramar Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 433-A online Miramar Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.