Award-winning PDF software

Form 433-A for Pompano Beach Florida: What You Should Know

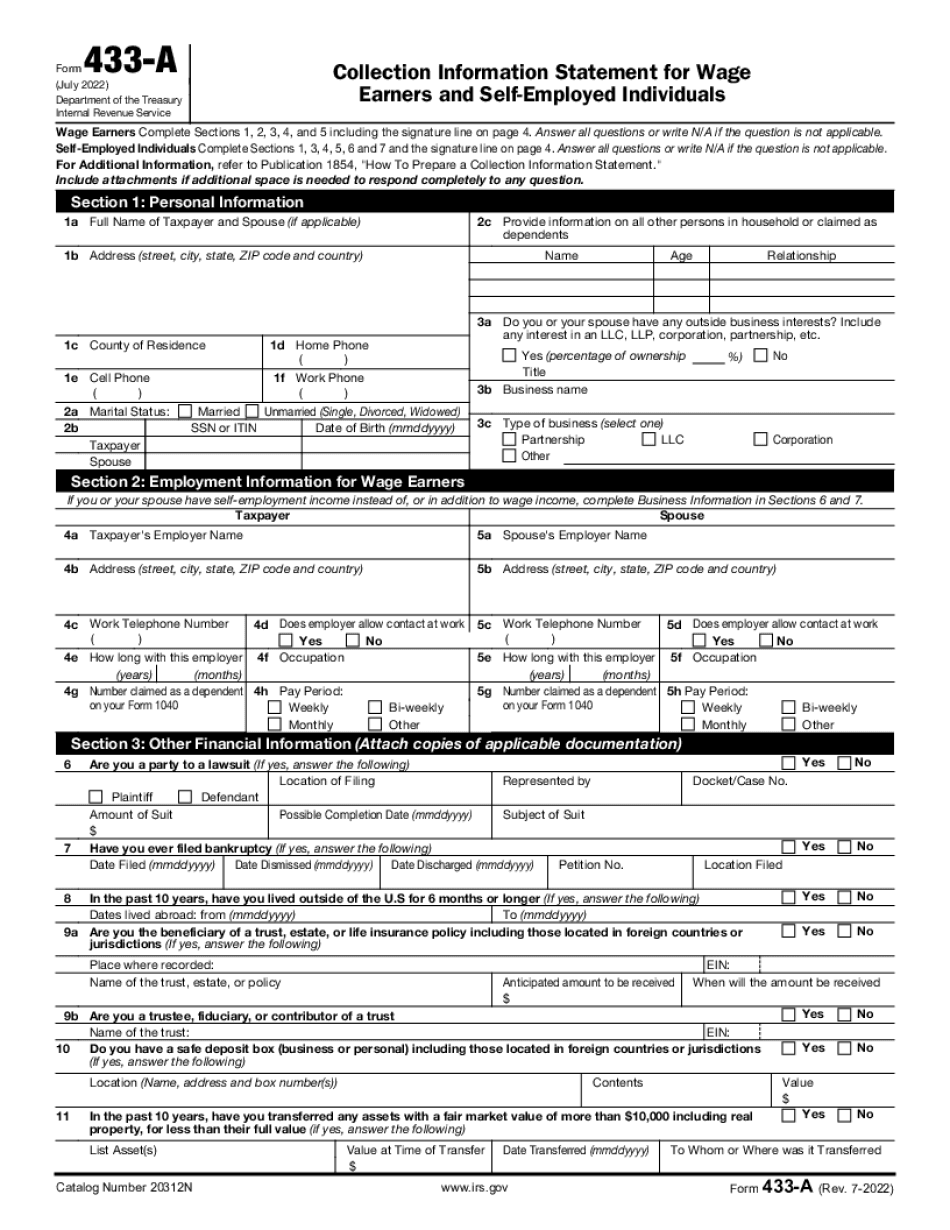

What Tax Is Collected — IRS This form should only be used with the Form 656, Offer in Compromise. Unmarried Married If married, date of marriage (mm/dd/YYY) Home physical address (street Form 433-A for Pompano Beach Florida — Fill Exactly for Your City Form 433-A for Pompano Beach Florida. Modify the PDF form template to get a document required in your city. Then just send it to the IRS! I had to get the tax paper for an apartment for me. And the Tax Assessor would not let me file a joint return. Could you let him know that? A: If you filed a joint return for the year, no problem, just go check at your city hall The Tax Organizer is a simple form that is easy to fill out and will provide all the necessary Form 433-A (OIC), Form, Form for 433-A (OIC). Instructions — Pompano Beach Reuse Water System The owner or their designated plumbing contractor must obtain a permit from the Parks & Rec Department. The permit must be for the plumbing contract. This document is for the landlord/the property owner who wants to use the building dump. This form will let you do so. I just got this on December 6th, and they are trying to go after us. They want 5% of the dump fee. Tax Exempt Organizations In Pompano Beach Florida — Tax Exempt Organizations in Pompano Beach Florida These tax-exempt organizations have the following tax exemptions: Charitable Organizations (501(c)3) that do not receive any state funds are exempt from paying state income tax. These include churches, homes for aged or handicapped persons, social clubs, museums, and hospitals. Social clubs whose income is tax-exempt are also exempt from state income tax. Nonprofit groups that qualify under Section 501(c)3 are tax-exempt under Section 501(a). 501(c)3 organizations have no state funds. For purposes of Section 501(a), “state funds” are defined as cash payments received from a local, state or federal agency, or any individual or corporation who provides funds to a 501(c)3 group. See Section 501(c)3 Charitable Organization Exemption for more information. For more information on the definition of “State Funds,” please review the guidelines contained in the Code of Federal Regulations.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 433-A for Pompano Beach Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 433-A for Pompano Beach Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 433-A for Pompano Beach Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 433-A for Pompano Beach Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.