Award-winning PDF software

Form 433-A for Eugene Oregon: What You Should Know

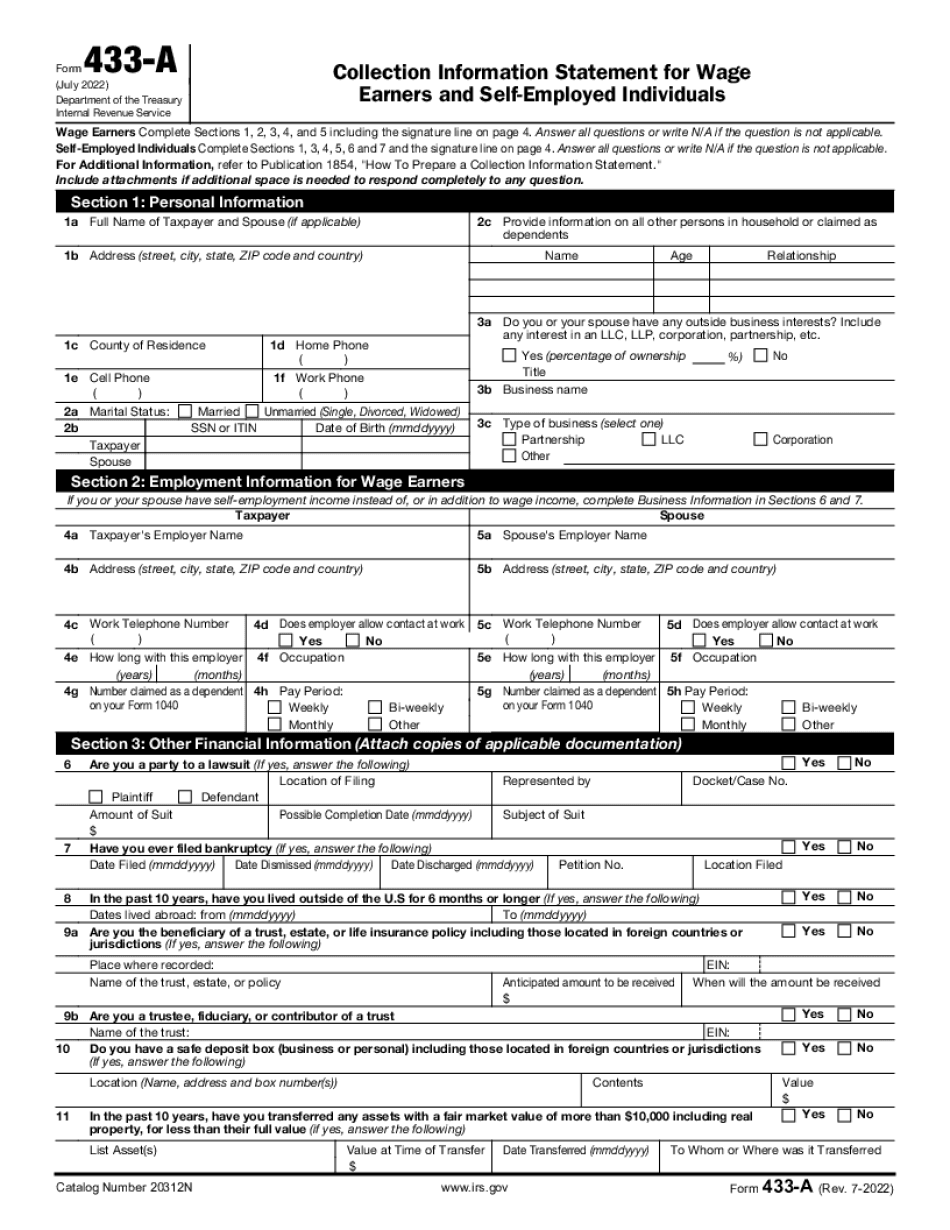

The form asks for: All of your SSN, Social Security number or any other form of ID Full name Age Monthly income Total monthly income for the last three months. We're going to focus mainly on the income portion of Form 433-A: The form starts out by stating: “This is a Community Tax Information Statement for wage earners and self-employed individuals.” We're now going to review “Complete the following statements as accurately and completely as possible.” “I am paying the taxes that I owe.” (You may have already indicated this information on your EZ-Check report.) Complete the appropriate statements. Your income must be reported in the boxes. Don't try to fill the form out on your own. The computer takes care of that! You don't have to sign your name. If you do, the process will be faster. In addition to the statement, you will need to provide information. The IRS form asks for: Social Security number or any government ID Your address Your county of residence. Your county of current residence (this doesn't have to be the same county from the last three months) Your state of residence Your zip code You may sign this section. No name or signature? If any of our clients have not provided their full name when they originally answered our survey, we can still help you complete the form. Complete a statement by signing under penalty of perjury. Your signature must be written exactly as it appears on the application form. Be careful to sign only once. Sign notarized, not photocopied, NOT typed. Don't sign with pen ink. A personal or household signature is not acceptable when submitting income information. We'll explain more about what personal or household signatures are acceptable below. Include your federal and state tax payments with this form. These payments are not tax-deferred. The same amount is taxable each year, regardless of their source. If your income has changed recently, we'll check your information against the information already provided by your employer. If you have a change in income, enter the new income and the correct gross income in the appropriate boxes. Note that withholding and interest are not collected on these amounts. This information has to be reported in the future.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 433-A for Eugene Oregon, keep away from glitches and furnish it inside a timely method:

How to complete a Form 433-A for Eugene Oregon?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 433-A for Eugene Oregon aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 433-A for Eugene Oregon from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.