Music. Hi, I'm Debbie Peverill and you're listening to the weekly tip from Penn's financial training group. Today, I'm talking about vehicle expenses and the ones that you can deduct on your personal tax return. It being March and tax season, there's a difference between receiving an allowance and being reimbursed. This applies to employees. If you receive an allowance from your employer, say $200 a month or a week, then that amount is taxable. It's going to be added to your t4 and therefore, it's going to be on your personal tax return as income. You can then deduct your business expenses for using your car on your tax return. So, this means keeping your gas receipts, your repairs and maintenance receipts, your insurance, everything to do with the vehicle. And there's a form, of course, which you would fill in. When the allowance is taxable, you can take a deduction for the business expenses. If instead of getting an allowance, you're being reimbursed, which means you're getting an amount per kilometer, that amount is not taxable and you don't have to make any kind of calculations on your personal return. You're being reimbursed. If that's the end of it, then there's nothing to put on your tax return. If, however, you feel that you're not being given enough money for your actual expenses, then you can fill in the form with all your gas receipts, all of your insurance, your repairs and maintenance, and of course, you have a mileage log which indicates how many kilometers you drove for business and how many kilometers you drove personally. You then would subtract from this calculation the amount you're reimbursed. If in fact your expenses, the business percentage of your expenses, is more than the reimbursement, then you're entitled to...

Award-winning PDF software

Allowable vehicle expenses Form: What You Should Know

Use the chart to find out whether you claim your vehicle expenses in the year you drove the vehicle. To be deductible, costs must be reasonable, and they must be reasonable and necessary, including: — Maintenance In order to deduct the costs of maintenance, you will need to be sure that you keep records showing that you have taken the necessary steps to maintain those materials, such as annual or monthly receipts for the vehicle or your repair records. In some cases you can claim to the full cost of your necessary maintenance; other times the cost of your maintenance will be part of the cost of your car, which you claim. Remember that any costs listed under cost of gas or oil are part of your cost of driving. For more information, refer to Cost of driving — Use the chart below to find out how much you can take out of your vehicle and how much of that you can write off as vehicle expenses. Cost of driving: Cost of gas/oil Cost of driving: Cost of oil/gas If you use your car for business purposes, you may be required to calculate business related car expenses to see if you can deduct the business related costs. If there is a high cost to operate as well as the number of business related expenses, you may be required to claim a deduction for these cost. If there is a low cost to run your business in addition to the number of business related expenses, you can claim a small or nontaxable deduction. Cost of driving: Cost of gas/oil/fuel Cost of driving: Use the chart below to find out how much you can take out of your vehicle and how much of that you can write off as vehicle expenses. Cost of driving: Cost of driving: Costs and deductions for Business Use of Cars You must maintain your automobile in a clean, safe, and serviceable condition at all times. You must not alter or remove the equipment on, or remove the identification tags from, your vehicle unless the alteration is for a lawful purpose such as repair or replacement. Cost of driving: Clean air and odor control.

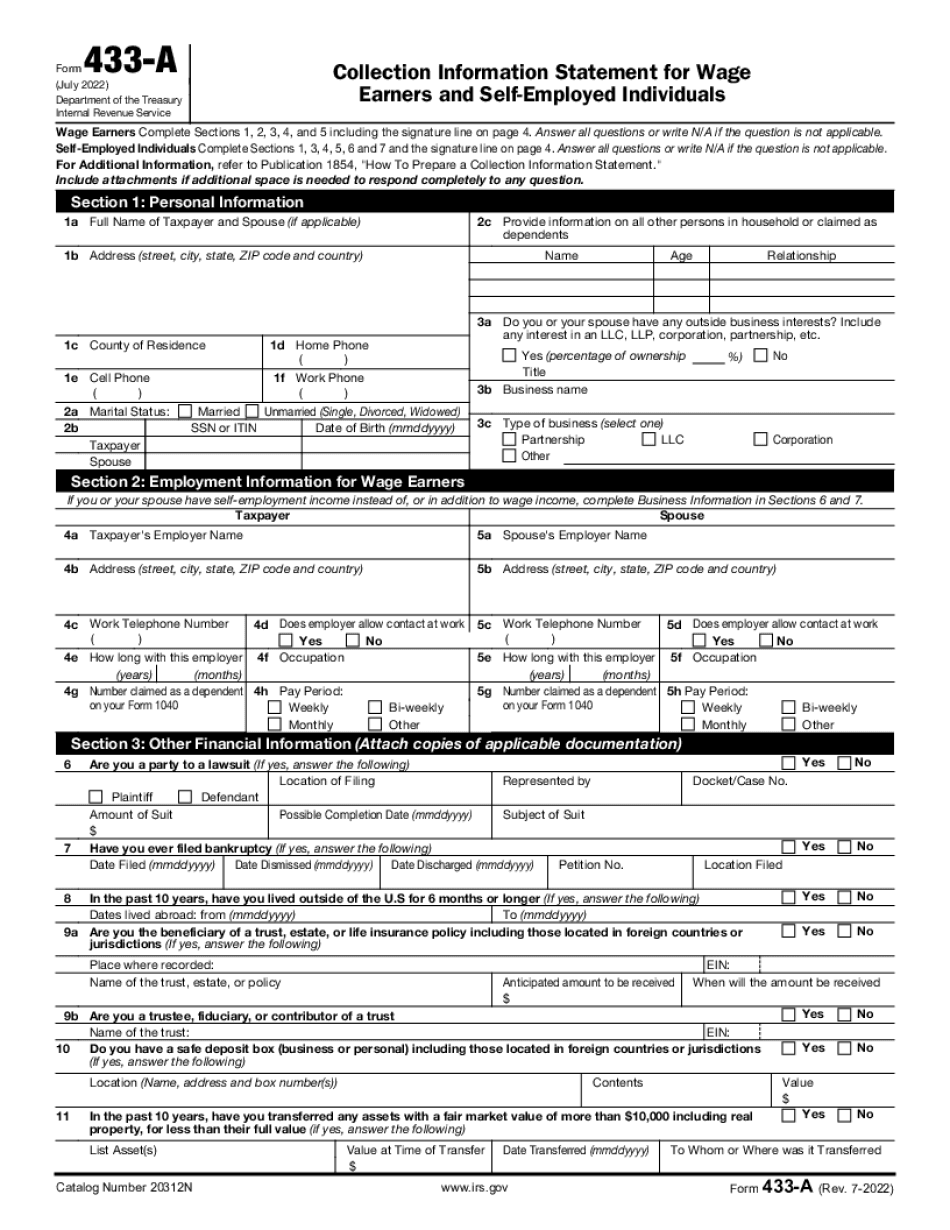

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 433-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 433-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 433-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 433-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Allowable vehicle expenses