Now, let's go to the next topic. This topic isn't quite as well known. It is called using business expenses to get money back when you travel. This is one of my favorite underrated topics. I learned this from traveling with big companies. I've worked for IBM and Deloitte, companies where I travel a lot. What I learned is that when I first joined IBM and some other companies, I would travel somewhere just to attend a meeting for like 10 minutes or just to be an observer in a meeting. I would think, "Wait a minute, you came all the way across the country to sit in a meeting for half an hour?" I would be speechless, wondering how the company is paying for this. And they do it because when you travel for work, all the expenses can be expensed by the company. These expenses include your flight, hotel, car rental, taxis, Ubers, and even your meals. The company takes them off from their taxes. This got me thinking, "Hold up, I can do the same thing." So, I learned about business expenses and realized that everyone should own a business just to decrease their taxes. People who own businesses help the economy, so by utilizing business expenses, you can decrease your expenses. Let me give you an example. Imagine you have a business as a travel blogger. Your job is to blog about traveling to different locations. As a travel blogger, you can book a flight from DC to Australia, spend a week there taking pictures and videos, and then come back to write about your experience. That flight to Australia, the hotel, and the meals you have are all part of your business expenses. Therefore, you can deduct them from your taxes, which means that portion...

Award-winning PDF software

Irs transportation expenses Form: What You Should Know

One Car Two Cars. Local. 1,000 Owner Costs. One Car Two Cars. Rural. 500 Owner Costs. One Car Two Cars. Rural. One Car. 200 Topic No. 552 Business Travel Expenses — IRS How to report business expenses. You cannot file a business owner's self-employment tax return or pay business tax on a self-employed person's wages. Self-employment income, wages, and other types of income are taxed as wages under Federal tax law. You need to file a self-employment tax return, or pay tax on the wages, on Schedule C (Form 1040) instead of Schedule C (Form 1040A). For more information on how to file Form 1040A and Form 1040EZ, see Publication 515, Tax Guide for Small Business. For more information on how to report payments made on behalf of a business to an employee, see Publication 515. Publication 548 Other Business Travel Expenses — IRS What are the most common expenses incurred in conducting a business activity? The IRS issues regulations describing most of the different categories of expenses that can be claimed and the criteria to use to determine whether you can deduct them. Learn more about the different tax situations that apply to business travel below. Annual Travel Expenses for travel in connection with the owner's business are deductible if: The travel for which the expenses are paid includes travel by air, railroad, or ferry to and from your home, and The travel for which the expenses are paid is in connection with your business and is not just for your family, friends, or community. See Publication 548 : Miscellaneous Activities and Tools for Small Business (2013 Edition), available at IRS.gov/pub/irs-pdf/p5p.pdf. Airport Fees Travel expenses that are not paid with or from the owner's regular salary are not deductible. This includes airplane ticket or taxi fare, hotel or motel room, car rent, car maintenance, taxi ride, tolls, parking and tolls. Publication 557, Travel Expenses, also describes travel expenses and costs that are deductible for these types of expenses under different circumstances. Public Transportation Costs The most common examples of travel expenses for business include train, bus, ferry, and automobile trips. You cannot deduct business travel expenses for travel in connection with a single-use personal item such as a laptop computer or printer.

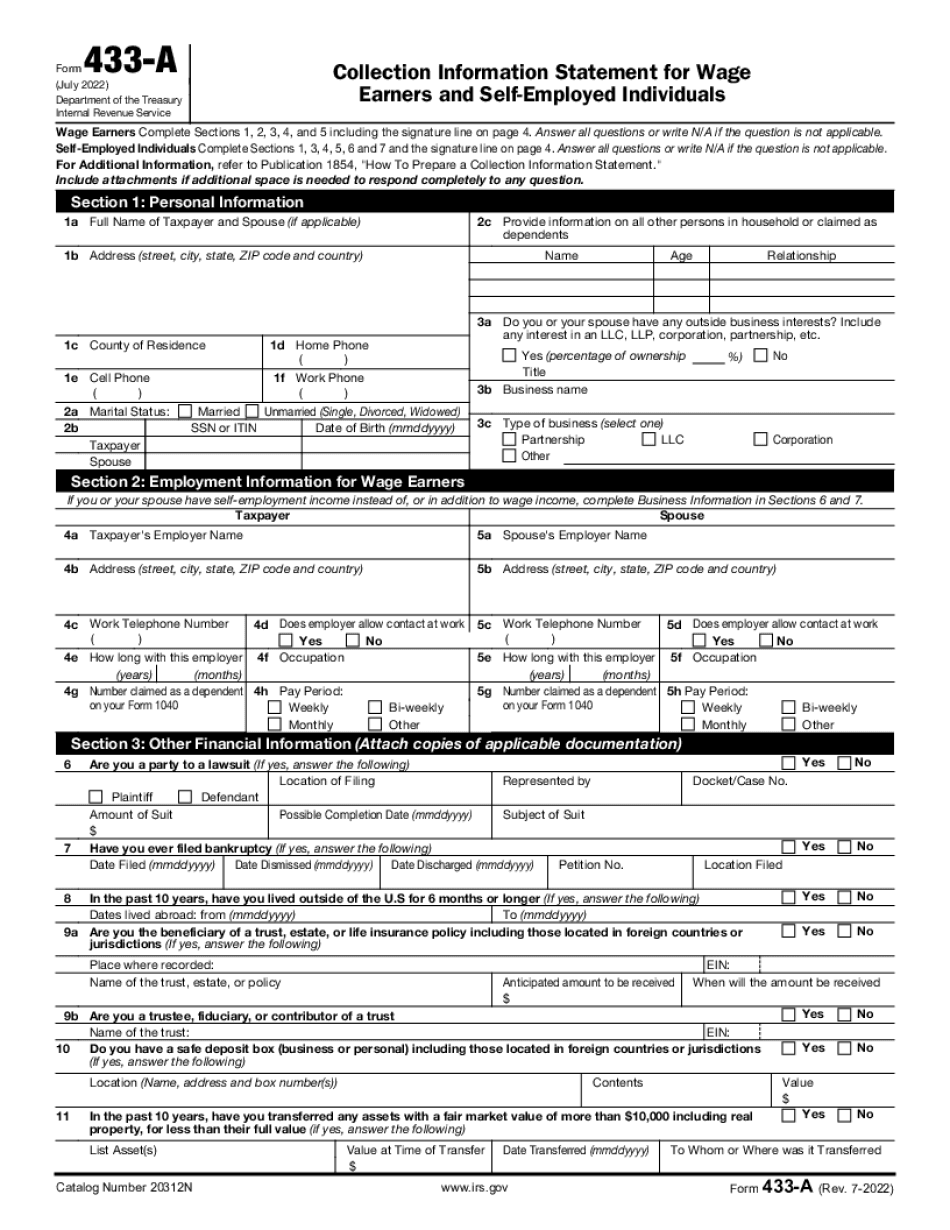

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 433-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 433-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 433-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 433-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs transportation expenses